You are driving home in a thunderstorm. A deer jumps out. You have a split-second choice: Hit the deer, or swerve into a guardrail. Most drivers don't realize that this physical reaction completely changes which insurance coverage pays for the damage—and how much your rates will go up.

"Comprehensive" and "Collision" are often sold together, but they cover completely different risks. Understanding the difference is the key to setting smart deductibles and avoiding "at-fault" marks on your driving record.

Key Takeaways

- ✓ The "Control" Rule: Generally, if you hit something (your fault), it's Collision. If something hits you (bad luck), it's Comprehensive.

- ✓ The Deer Trap: Hitting an animal is a "Not At Fault" Comprehensive claim. Swerving and hitting a tree is an "At Fault" Collision claim.

- ✓ Deductibles Can Differ: Smart shoppers keep a high Collision deductible ($1,000) but a low Comprehensive deductible ($250) for windshields/theft.

- ✓ Price Difference: Collision is expensive (often $500+/year). Comprehensive is cheap (often $50-$100/year).

Table of Contents

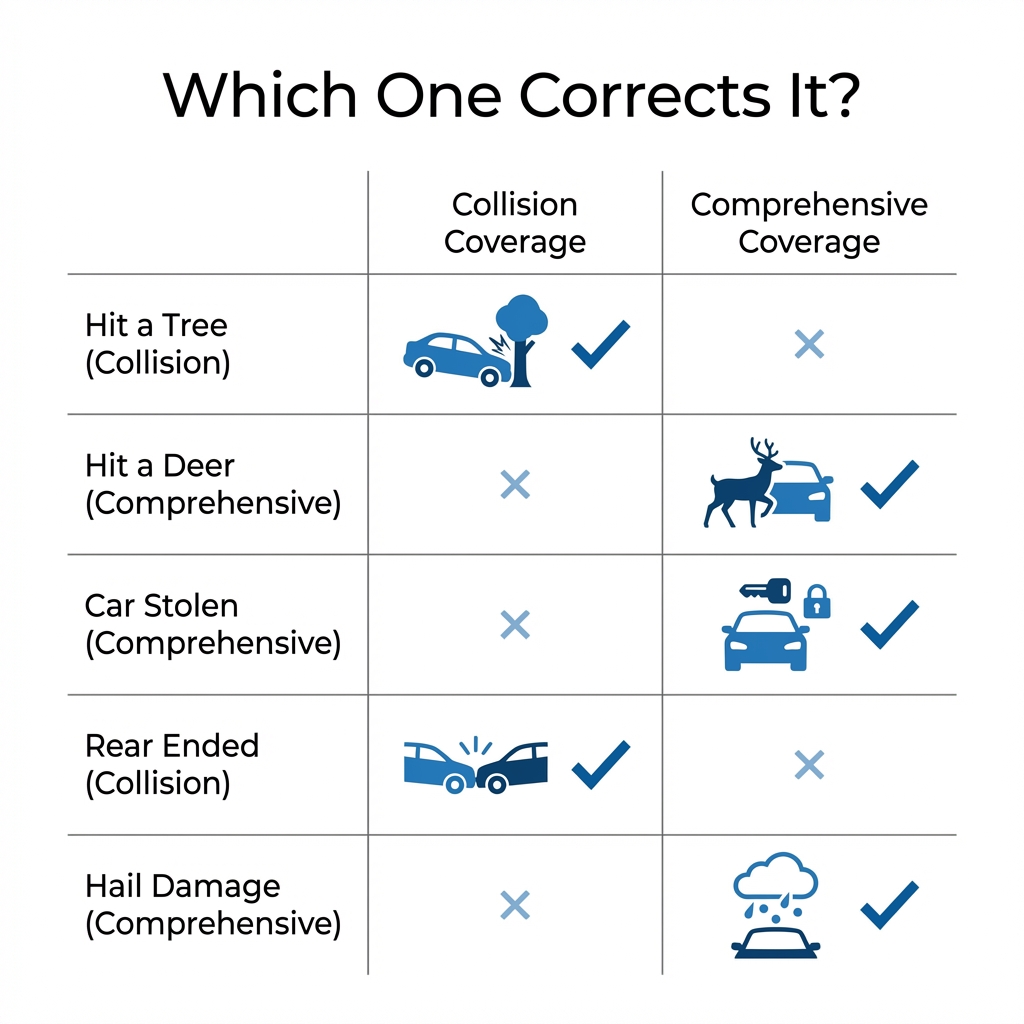

1. The Scenario Matrix

Stop guessing. Here is the definitive breakdown of which coverage applies to common 2026 road hazards.

2. Deep Dive: Comprehensive Coverage

Think of Comprehensive as "Bad Luck Insurance." It covers damage to your car that is generally out of your control.

- Theft & Vandalism

- Fire & Floods

- Hail & Wind Damage

- Falling Objects (Trees)

- Hitting an Animal (Deer/Moose)

- Broken Glass (Windshields)

- It's Cheap: Usually costs $5-$15/month.

- No Rate Hikes: In many states, Comprehensive claims do NOT raise your rates because they aren't "At Fault."

3. Deep Dive: Collision Coverage

Think of Collision as "Accident Insurance." It pays to fix your car when you hit something.

- Hitting another car

- Hitting a stationary object (Pole/Wall)

- Rolling over (Single car accident)

- Pothole damage

- It's Expensive: Can cost $50-$100/month (impacting premiums significantly).

- Rate Hikes: Using this usually marks you as "At Fault," raising your premiums for 3-5 years.

4. The "Deer vs. Tree" Trap

This is the classic insurance textbook example.

Scenario A: You hit the deer.

Your hood is smashed. This is a Comprehensive claim ("Animal Strike").

Result: You pay your deductible. Your rates usually stay flat.

Scenario B: You swerve and hit a tree.

Your hood is smashed. This is a Collision claim ("Single Vehicle Accident").

Result: You pay your deductible. You are marked "At Fault." Your rates go up 30% for 3 years.

Pro Tip: We never tell you to hit an animal intentionally. Safety first. But financially speaking, the insurance logic prefers the animal strike over the swerve.

5. The "Split Deductible" Strategy

Most people set their deductibles to the same number (e.g., $500/$500). That is a mistake. Because Collision is expensive and Comprehensive is cheap, you should split them.

| Strategy | Collision Deductible | Comprehensive Deductible | Why? |

|---|---|---|---|

| The "Smart Saver" | $1,000 | $250 | Lowers your monthly bill (high collision ded) but protects you from cheap glass/theft claims (low comp ded). |

| The "Max Risk" | $2,000 | $2,000 | Only for people with big emergency funds. Huge savings, but big risk. |

Frequently Asked Questions

Can I buy Comprehensive without Collision?

Yes, if your car is paid off. This is common for older cars where you want protection against theft and hail, but don't want to pay for expensive collision coverage.

Does Collision cover mechanical breakdown?

No. If your engine blows up or your transmission fails, that is maintenance (or an Extended Warranty). Insurance only covers sudden, accidental damage.

What if a rock cracks my windshield?

This falls under Comprehensive. In some states (like FL, KY, SC), insurance companies are required by law to replace windshields with ZERO deductible.