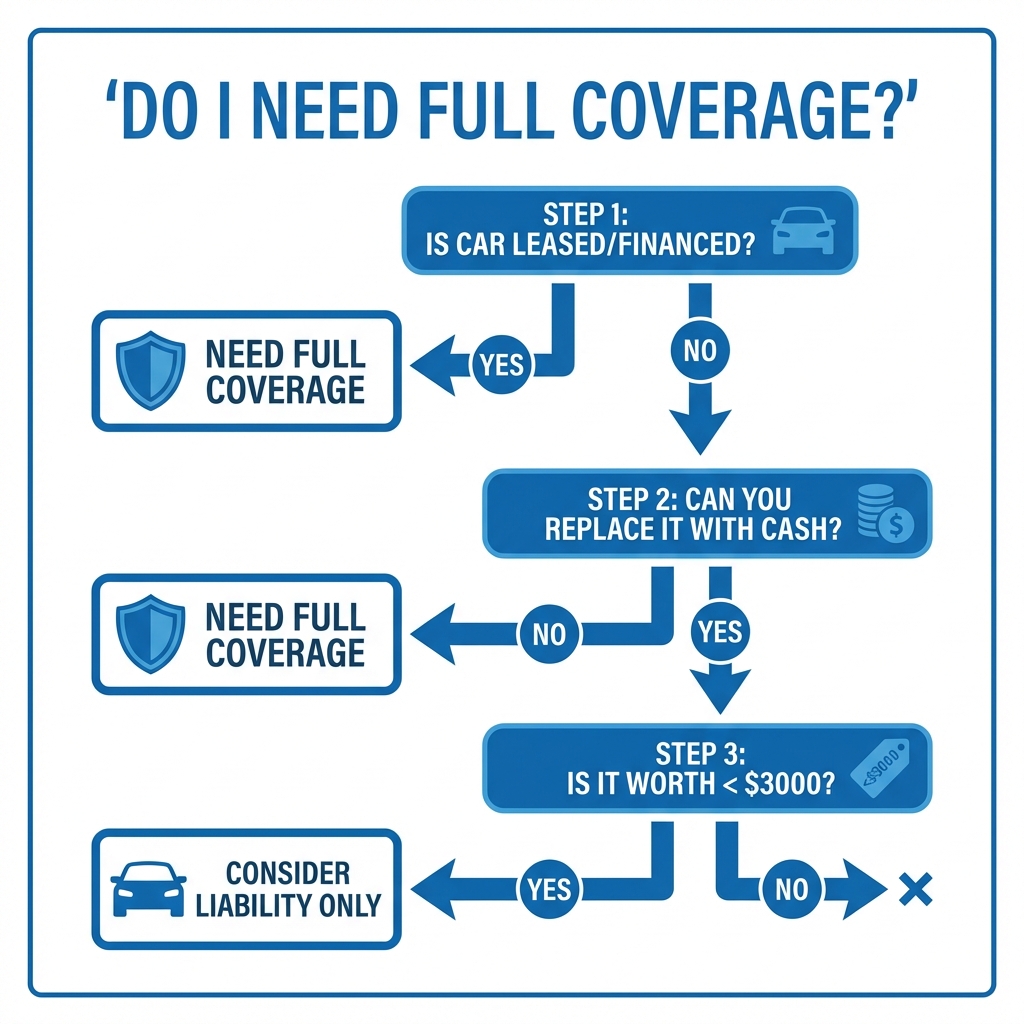

It is the most common question in car insurance: "My car is getting older—should I drop full coverage?" In 2026, the answer is trickier than ever. Used car values are fluctuating, while repair costs are skyrocketing.

Making the switch to "Liability Only" can cut your premium in half instantly. But if you make the jump too early, a single hailstorm or parking lot dent could leave you with a $0 payment. This guide replaces guesswork with a clear financial formula.

Key Takeaways

- ✓ The "10% Rule": If your annual full coverage cost is more than 10% of your car's replacement value, it's usually time to drop it.

- ✓ Loans Require It: You cannot drop full coverage if you have an active loan or lease. The bank forces you to keep it.

- ✓ Savings vs. Risk: Dropping full coverage means YOU become your own insurer for theft, vandalism, and collision repairs.

- ✓ The Middle Ground: Consider keeping Comprehensive (cheap) but dropping Collision (expensive) for older cars.

Table of Contents

1. The Difference: "Full" vs. "Liability"

First, let’s kill a myth. "Full Coverage" is not a specific policy you buy off a shelf. It is a bundle of three separate coverages.

Full Coverage Bundle

- ✓ Liability: Pays for others.

- ✓ Collision: Fixes YOUR car if you crash (see comp vs collision).

- ✓ Comprehensive: Fixes YOUR car if stolen/hailed on.

Liability Only

- ✓ Liability: Pays for others.

- ✗ Collision: You pay 100% of your own repairs.

- ✗ Comprehensive: You pay 100% of theft/weather loss.

2. When Full Coverage is Mandatory

Before you do any math, check your legal status. If you financed or leased your car, your lender holds the title.

The "Lienholder" Clause

Your loan contract requires you to protect the bank's asset. If you drop full coverage, the bank will receive a notice. They will then purchase "Force-Placed Insurance" for you. It is often 3x more expensive than your own policy. Never drop coverage on a financed car.

3. The Math: When to Switch

If you own the title (no loan), the choice is yours. Use the "10% Rule" to decide.

The Calculation

- Get Your Car's Value (ACV): Check Kelley Blue Book for "Private Party Value." (e.g., $4,000).

- Subtract Your Deductible: If you have a $1,000 deductible, your max payout is $3,000.

- Get the Cost of Coverage: Look at your bill. How much is specifically for "Collision" and "Comprehensive"? (e.g., $600/year).

- The Result: You are paying $600 to protect a maximum specific payout of $3,000. That is 20% of the value. Bad Deal.

Guideline: If the premium cost > 10% of the max payout, switch to Liability Only. You are better off putting that $600 into a savings account for a new car.

4. Hidden Risks of Dropping Coverage

Saving money feels great until disaster strikes. Remember what "Liability Only" really means:

- Theft: If your car is stolen, you get $0.

- Hit & Run: If you come back to a smashed bumper in a parking lot, you pay 100% of the repair.

- Weather: If a tree falls on it, you pay for the crusher.

The "Comp-Only" Compromise

If you are worried about theft or deer but don't want to pay for expensive Collision coverage, ask your agent if you can keep "Comprehensive Only" added to your Liability policy. It’s often very cheap ($5-$10/month) and protects against non-driving disasters.

Frequently Asked Questions

Does liability insurance cover my passengers?

It depends. Liability BI covers people in the other car. Passengers in your car are usually covered by your Medical Payments (MedPay) or PIP coverage, not your BI liability.

Can I drop full coverage in the summer if I don't drive?

Be careful. If you drop Comprehensive, you have no coverage for theft or fire while it sits in the garage. Some insurers offer "Storage Insurance" which is essentially Comprehensive-only for parked cars.

Does full coverage pay off my loan?

Not always. It pays the "Market Value" of the car. If you owe $15,000 but the car is worth $12,000, you are still on the hook for the $3,000 difference unless you have GAP Insurance.