You bought a new car for $40,000. You drive it off the lot, and it is instantly worth $35,000. A week later, it gets totaled. Your insurance writes a check for $35,000. But the bank still wants their full $40,000. Who pays the missing $5,000? You do. Unless you have Gap Insurance. (It typically has a low impact on premiums).

In 2026, finding yourself "underwater" (owing more than the car is worth) is common again as used car prices stabilize. This guide explains how to protect your wallet without paying inflated dealership prices. (See: How Vehicle Choice Impacts Costs. Also, check our Diminished Value Guide if your car loses value after a repair).

Key Takeaways

- ✓ The Dealer Markup: Dealers often charge $600-$1,000 for Gap Insurance. Your auto insurer usually sells it for $20-$40 per year.

- ✓ Who Needs It: If you put less than 20% down, have a loan longer than 60 months, or rolled in negative equity, you need Gap.

- ✓ Who Can Skip It: If you made a huge down payment (>30%) or paid cash, you have zero "Gap risk."

- ✓ When to Drop It: Gap is temporary. Once your loan balance is lower than the car's value, cancel the coverage and save the money.

Table of Contents

1. What is "The Gap"?

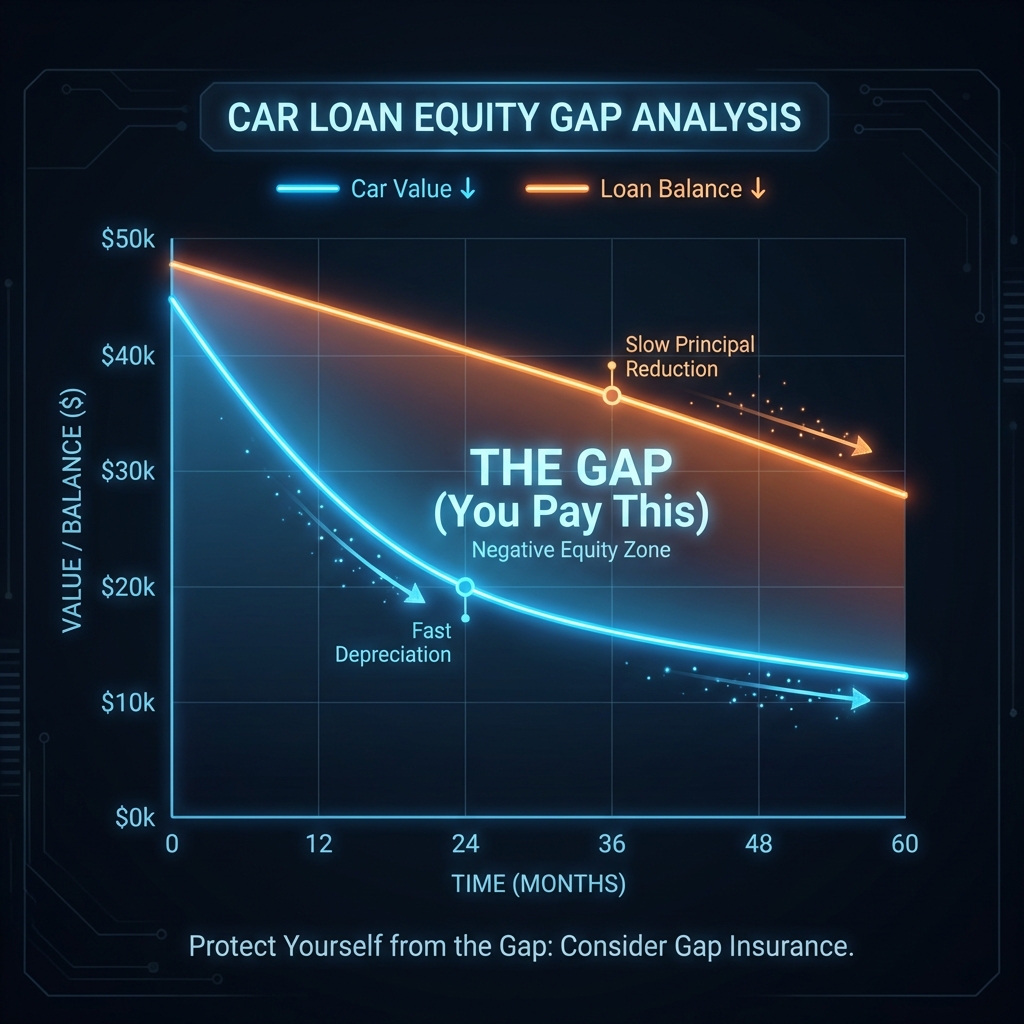

GAP stands for Guaranteed Asset Protection (though mostly it's just called "Gap"). It covers the difference between your vehicle's Actual Cash Value (ACV) and the amount you owe on your loan.

2. Dealer vs. Insurer: The Price War

This is the biggest secret in the car buying process. The product is the same, but the price is wildly different.

Buy From Dealer

- Cost: $600 - $1,200 (One time fee).

- Financing: Often rolled into your loan, so you pay interest on it for 6 years.

- Pros: Convenience. It's done.

- Cons: Massive markup. Hard to get a refund if you pay off early.

Buy From Insurer

- Cost: $20 - $60 per year (added to monthly premium).

- Financing: Interest-free.

- Pros: Save 90%+. Cancel anytime instantly.

- Cons: You have to remember to ask for it.

- Is this part of Full Coverage?

3. Loans vs. Leases

4. The Math: Do You Need It?

Don't guess. Do the math.

- Loan Balance: Check your bank app. (e.g., $28,000).

- Car Value: Check KBB.com "Private Party Value." (e.g., $24,000).

- The Result: $28k - $24k = -$4,000.

If the number is negative, you are "Underwater." If that car is totaled today, you owe $4,000 cash. Buy Gap immediately.

If the number is positive (e.g., you owe $15k but it's worth $20k), you have Equity. You do not need Gap.

Frequently Asked Questions

Can I add Gap later?

Usually, yes—but there's a time limit. Most insurers allow you to add it within 12-36 months of buying the car. Some require it to be added within 30 days of purchase.

Does Gap pay my deductible?

Sometimes. Some policies cover your $500 or $1,000 deductible as part of the payout. Others do not. Check the fine print.

What if I roll "Negative Equity" into a new loan?

This is dangerous. If you trade in a car you owe money on, and add that debt to the new loan, your Gap risk is huge. You absolutely need Gap insurance in this scenario.