Imagine this: You are stopped at a red light. BAM! A distracted driver slams into you at 40 MPH. You wake up in the ER with a broken leg and $50,000 in medical bills. You ask for the other driver's insurance info. The police officer shakes his head: "He doesn't have any."

This nightmare happens thousands of times a day. In 2026, with insurance rates rising, more people are driving naked (uninsured). Uninsured Motorist (UM) coverage is the only thing standing between you and bankruptcy in this scenario.

Key Takeaways

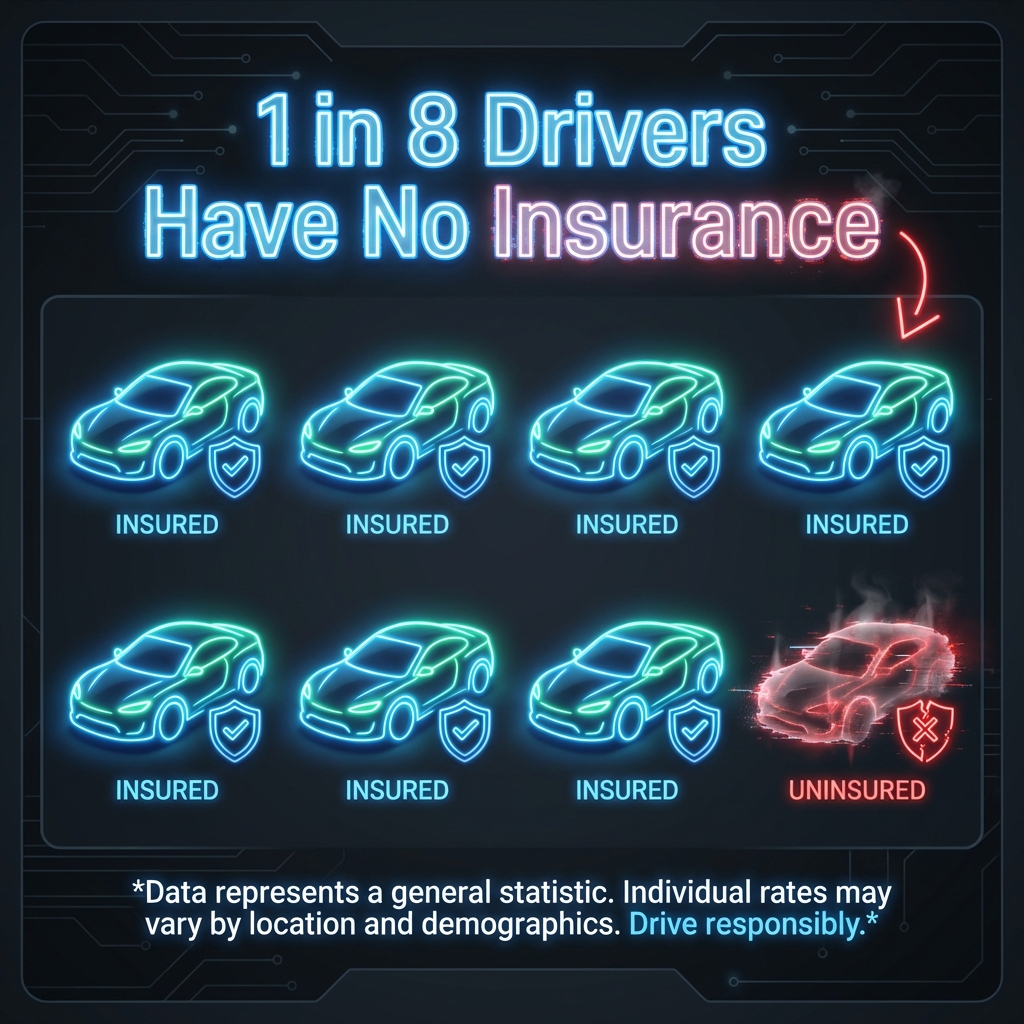

- ✓ The "1 in 8" Stat: Nationally, 12% of drivers have zero insurance. In stats like Florida or Mississippi, it's nearly 1 in 4.

- ✓ UM vs. UIM: "Uninsured" helps when they have NO insurance. "Underinsured" helps when they have bare-minimum limits (like $15k).

- ✓ Health Insurance Isn't Enough: Your health plan has deductibles and co-pays. It also won't pay for lost wages or pain & suffering. UM (and MedPay) does.

- ✓ Stacking: In some states, you can "stack" coverage across multiple cars for huge limits. Always say YES to stacking.

Table of Contents

1. What is UM/UIM?

These are two distinct but related coverages found on your Declarations Page.

Uninsured Motorist (UM)

Pays for your medical bills and lost wages if the at-fault driver has zero insurance or if it is a Hit-and-Run. (Hit-and-Run Steps).

Underinsured Motorist (UIM)

Pays the difference if the at-fault driver has insurance, but their limits run out.

Example: They have $25k limits. Your bills are $100k. UIM pays the remaining $75k.

2. Why Health Insurance Isn't Enough

"I have good health insurance, why do I need this?" We hear this every day. Here is the math.

| Expense | Health Insurance | UM/UIM Coverage |

|---|---|---|

| Hospital Bills | Yes (after deductible) | Yes (first dollar) |

| Lost Wages | No | Yes |

| Pain & Suffering | No | Yes |

| Deductibles | You pay ~$2k-$6k | Covers your health deductible |

3. The Power of "Stacking"

If you live in a state that allows "Stacking" (like Pennsylvania or Florida), use it. Stacking multiplies your coverage by the number of cars on your policy.

The Stacking Multiplier

You have 3 cars. You buy 100/300 UM limits.

Unstacked: You have 100/300 limits.

Stacked: You have 300/900 limits.

The cost? Usually only $10-$20 extra per year.

4. Recommended Limits for 2026

Never just buy the state minimum. With medical inflation running at 6%+, a $25,000 limit is gone in 24 hours at a trauma center.

- Minimum Recommended: 100/300 ($100k per person / $300k per accident). This usually covers a moderate surgery and some lost time at work.

- Ideal: 250/500 Better protection for serious injuries. Often costs less than $5/month more than 100/300.

Frequently Asked Questions

Does UM cover my car damage?

It depends. In some states, there is a separate "UMPD" (Uninsured Motorist Property Damage). In others, you must use your Collision deductible. Check with your agent.

Is a Hit-and-Run considered Uninsured?

Yes, in most cases. If the other driver cannot be identified, your UM Bodily Injury coverage kicks in. However, you MUST file a police report to prove it wasn't just your error.

Can I drop UM if I have full coverage?

Technically yes, but it is a terrible idea. "Full Coverage" (Collision/Comp) protects your CAR. UM protects your BODY. They do completely different jobs.