Auto insurance pricing shifted dramatically in 2025 and early 2026. Carriers leaned hard into telematics, refiled rates with regulators to combat inflation, and tweaked discounts for EVs and remote work. If you are still simply "auto-renewing" your policy, you are likely overpaying by hundreds of dollars.

Treat your premium like any recurring bill you negotiate. These 15 tactics stack together so you can save hundreds now and thousands over the life of your vehicle. This isn't about cutting necessary coverage—it's about optimizing your premium to pay the absolute minimum for the protection you need.

Key Takeaways

- ✓ Telematics is King: Safe driving apps are now the single biggest discount available (up to 40%).

- ✓ Bundle Smart: Combining home and auto can save you more than the cost of a renters policy itself.

- ✓ Credit Matters: In most states, improving your credit score from "Fair" to "Good" drops rates by 17%.

- ✓ Shop Yearly: Loyalty penalties are real. Shopping every renewal is the only way to keep rates check.

Table of Contents

The Quick Impact Map

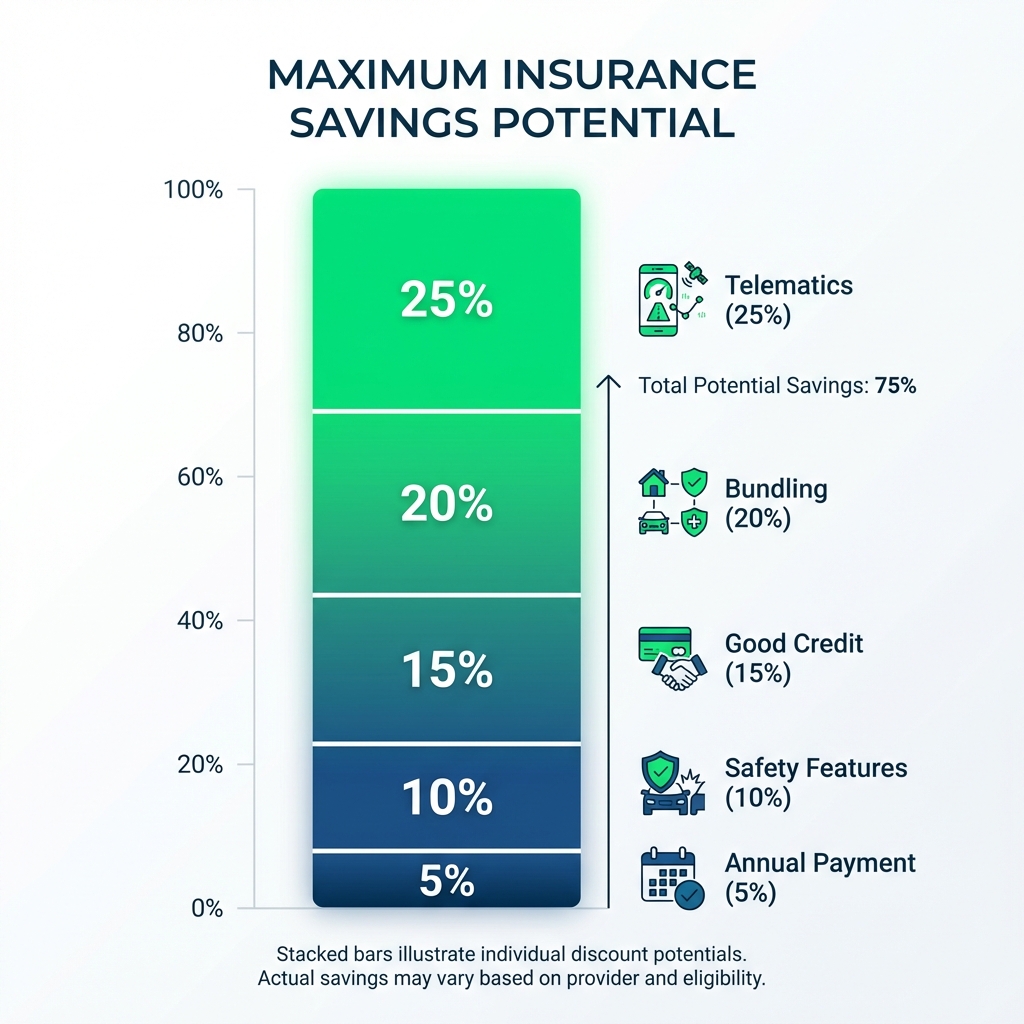

Strategies stack. Implementing all of them creates the "Savings Wall" effect.

Not all moves are created equal. If you only have 20 minutes, focus on the high-impact actions first.

| Move | Typical 6-mo impact | Time to complete |

|---|---|---|

| Re-shop 3-5 carriers | Save $150-$400 | 1 hour |

| Enroll in telematics | Save 10%-40% | 20 minutes |

| Raising deductibles | Save $50-$150 | 15 minutes |

| Bundle home/renters | Save 5%-25% | 30 minutes |

Steps 1-3: Audit Your Policy Data

Insurers base your rate on data that often goes stale. Start here so you are quoting with clean info. A surprisingly large number of overpayments happen simply because the insurer thinks you drive 15,000 miles a year when you actually drive 8,000.

Confirm Garaging Address

Did you move? Is your car listed at your parents' house? Confirm your ZIP code is correct. Also, ensure the "garaging type" is accurate. Parking in a locked garage is cheaper than street parking in many urban areas.

Update Annual Mileage

If you work from home now, update your mileage. dropping from 12,000 to 7,500 miles/year moves you into a "pleasure use" or "low mileage" tier with most carriers. This alone can drop rates by 5-10%.

Audit Driver List

Remove drivers who moved out or have their own insurance (like college grads). Conversely, ensure you add teens before the insurer finds them via database sweeps, which can lead to back-charges.

Steps 4-7: Re-shop and Restructure Coverage

Loyalty rarely pays in insurance. The "loyalty discount" carriers offer (usually < 5%) is often dwarfed by the "price optimization" logic that slowly raises rates on customers who don't shop around.

Quote 5+ Carriers

Don't stop at one. Include direct writers (Geico, Progressive) and regional mutuals (Erie, Amica, Auto-Owners). Use identical limits to our compare quotes guide so you are comparing apples to apples.

Right-size Coverage

If your car is 10+ years old, check the Blue Book value. If the car is worth less than $4,000, paying $500/year for collision coverage might not make financial sense. Also, if you have AAA, remove "Towing and Labor" from your policy.

Adjust Deductibles

Raising your deductible from $500 to $1,000 can save 15-30% on collision/comprehensive premiums. MAKE SURE you have that $1,000 in an emergency fund before doing this. Read more in our deductibles guide.

Bundle Smartly

Pair auto with home, renters, or umbrella policies. This is the "sticky" discount insurers love, so they price it aggressively. See the full bundling math here.

Deep Dive: The Bundling Math

Many renters skip renters insurance to "save money," not realizing that buying it might actually lower their total monthly bill due to the multi-policy discount (MPD) on their auto insurance.

Scenario A: Auto Only

Scenario B: Bundled

Result: You get free renters coverage AND save $30/year cash.

Steps 8-11: Stack Every Discount

Carriers have dozens of discounts, but agents might not apply them all unless you ask.

Telematics

Drivewise, SmartRide, IntelliDrive. Gentle driving for 90 days unlocks the biggest credit available today. Learn more about safe driving programs.

Profession/Affinity

Engineers, teachers, nurses, and alumni often get specific group rates. Send proof of your degree or license.

Vehicle Safety

ADAS, anti-theft devices, and VIN etching. If you added an aftermarket alarm, send the receipt.

Continuous Insurance

Avoid lapses at all costs. A 1-day lapse can spike your rate by 20% for 6 months.

Deep Dive: Is Telematics Worth the Privacy Trade?

Usage-Based Insurance (UBI) is no longer a niche product. In 2026, it's virtually required to get the lowest possible rate. But how does it work?

- Hard Braking: The #1 killer of discounts. Slow down gradually.

- Time of Day: Driving between 11 PM and 4 AM is high-risk.

- Phone Usage: Some apps detect if you pick up your phone while moving (distracted driving).

Pro Tip: Most programs offer a "trial period" (e.g., 90 days). Once you complete it, the discount is locked in for the life of the policy. You don't have to be tracked forever with every carrier.

Steps 12-13: Optimize Payments and Credit

12. Payment Hygiene

- ✓ Pay in Full: Most carriers charge $5-$10 per month for "installment fees." Paying in full saves $60-$120/year instantly, plus a paid-in-full discount (often ~5-10%).

- ✓ EFT / Auto-Pay: If you can't pay in full, at least use auto-pay to avoid "paper statement fees" compared to mailed bills.

13. Credit Health

In most states (except CA, HI, MA, MI), credit history is a major rating factor. Insurers use a "Credit-Based Insurance Score."

The Impact

Moving from Fair to Good credit can save ~17%.

Moving from Good to Excellent can save ~20% more.

Steps 14-15: Smart Vehicle Choices

Your driving record follows you, but your vehicle choice is the variable you can change.

Check Insurance Costs Before Buying

Never buy a car without calling your agent first. A "sport" trim might have a higher symbol rating than the base model, costing hundreds more per year. Check our guide to cheapest cars to insure.

Storage & Seasonal Use

Have a convertible you only drive in summer? Or a truck for weekend projects? Rate it as "pleasure use" or put it on "comprehensive only" (storage) mode during off-seasons.

Scripts that work

Discount Review Script

"I'd like to do a full review of my policy. Can we please run through every available discount category—specifically telematics, professional groups, and vehicle safety features? I want to make sure nothing was missed."

Competitor Match Script

"I've received a quote from [Competitor] for $[Amount] with the same 100/300 limits. I'd prefer to stay with you, but I need you to sharpen the pencil. Is there any way to get closer to this number?"

Frequently Asked Questions

Can I lower my car insurance without changing companies? ▼

Yes. You can lower your rate with your current carrier by raising your deductibles, dropping unnecessary coverages (like rental reimbursement if you have an extra car), enrolling in their telematics program, or removing drivers who no longer live with you.

How much does raising my deductible save? ▼

Generally, raising your deductible from $500 to $1,000 can reduce your collision and comprehensive premiums by 15% to 30%. However, this only applies to the physical damage portion of your bill, not the liability portion.

Does checking around for quotes hurt my credit score? ▼

No. Insurance inquiries are considered "soft pulls" and do not affect your credit score. You can quote as many carriers as you simply without worrying about damaging your credit rating.