Insurance costs vary as much as sticker prices. It is entirely possible to buy two cars for exactly $30,000, yet one costs $800/year to insure and the other costs $2,000/year. For more tips on reducing your rate, check out our 15 proven ways to lower premiums.

We analyzed 2026 filings from major carriers, IIHS crash data, and repair cost studies to build this shopper-friendly list. These vehicles routinely quote below the national average because they hit the insurer's "trifecta": they don't break easily, they protect passengers when they do crash, and they are cheap to fix. Learn more about how vehicle choice impacts costs.

Key Takeaways

- ✓ The "Boring" Factor: Insurers love predictable cars. A Subaru Outback often costs 40% less to insure than a similar-priced luxury coupe.

- ✓ Safety Pays: Vehicles with "Top Safety Pick+" ratings from IIHS get automatic discounts because occupants get injured less often.

- ✓ Theft Alert: Avoid cars with high theft rates (like certain older Kias/Hyundais) unless they have the new immobilizer software verified.

- ✓ Parts Availability: Mass-market cars (Toyota, Honda, Ford) have cheap, plentiful bumpers and fenders, keeping collision claims low.

Table of Contents

The "Secret Sauce" of Cheap Insurance

Why does a Honda Odyssey cost less to insure than a Honda Civic Si? It comes down to four specific data points insurers track relentlessly.

1. Loss History

Insurers look at the aggregate data of everyone who drives this car. Minivans are driven by parents with kids (cautious). Sports coupes are driven by... well, people who like to go fast. You inherit the risk profile of your "peer group."

2. Crashworthiness

Medical claims (injury liability and PIP) are the most expensive payouts. Cars with superior crash structures (IIHS Top Safety Pick+) keep occupants out of the hospital, saving insurers millions.

3. Parts & Labor

A headlight for a luxury car might cost $2,500 and require coding by a dealer. A headlight for a Ford Escape might cost $300 and snap in. Mass-market cars with simple tech win here.

4. Theft Ratio

If a car is easy to steal (like older Kias without immobilizers) or highly targeted for parts (like catalytic converters on Prius or trucks), comprehensive premiums skyrocket.

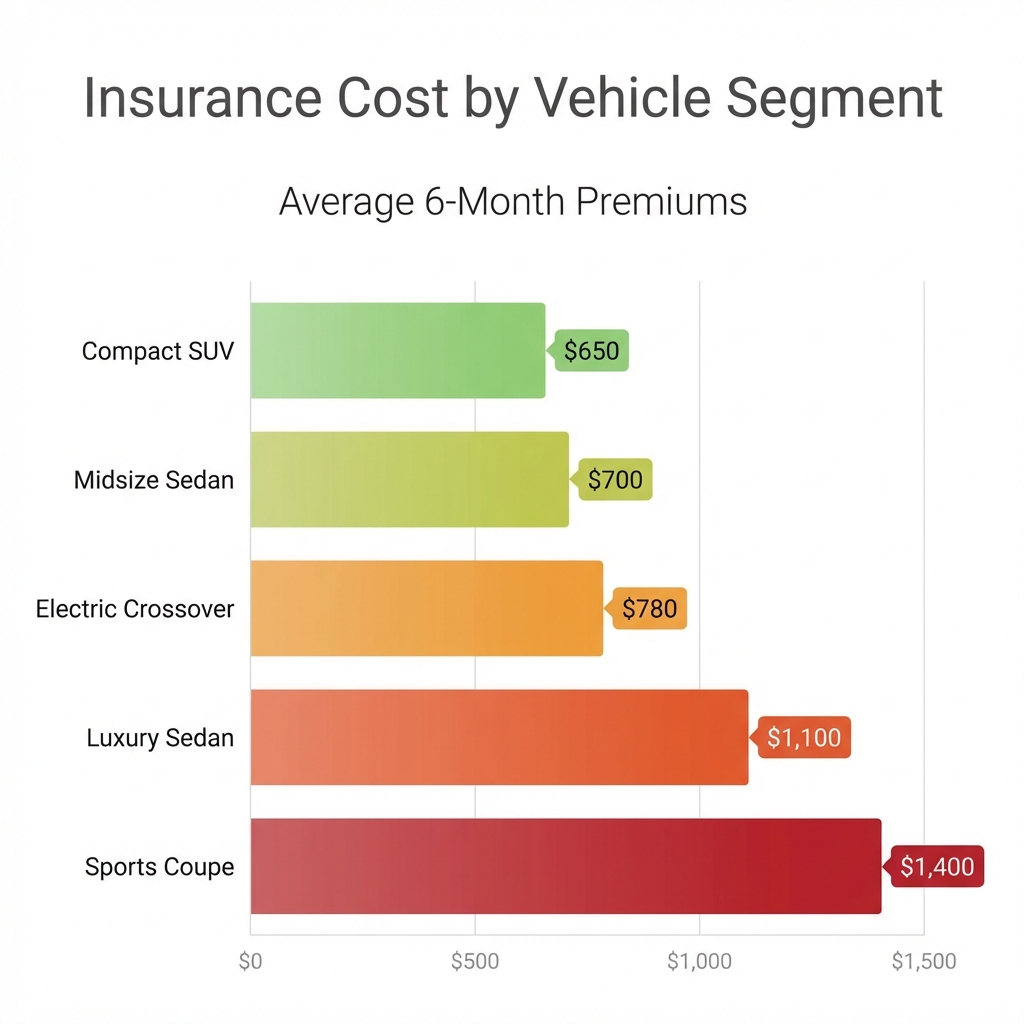

Cost by Vehicle Segment

Compact SUVs and Midsize Sedans remain the "sweet spot" for affordability in 2026.

Top 5 Sedans & Hatchbacks

Sedans generally have lower repair costs than SUVs due to less complex drivetrains and lighter weight (less damage to others).

| Model | Why Insurers Love It | Insurance Verdict |

|---|---|---|

| 2026 Honda Civic | Ubiquitous parts, excellent safety cage. | Best All-Rounder |

| 2026 Toyota Corolla Hybrid | Low horsepower (less risk), huge durability. | Cheapest to Own |

| 2026 Subaru Impreza | Standard EyeSight collision avoidance reduces rear-end claims. | Best Safety Tech |

| 2026 Mazda3 | Top Safety Pick+, mature driver demographic. | Best for Adults 30+ |

Top 5 SUVs & Crossovers

Crossovers fit families, and families tend to drive carefully. This demographic shift makes many small SUVs cheaper to insure than their sedan counterparts.

1. Subaru Crosstrek

#1 PickThe Crosstrek is a phenomenon. It has one of the lowest bodily injury claim rates in the industry thanks to EyeSight technology. It's essentially a lifted Impreza, meaning parts are cheap, but it retains the safe driving record of a family hauler.

2. Honda CR-V

ReliableA best-seller for decades means junkyards are full of spare bumpers and doors. This parts surplus keeps collision repair costs lower than newer, rarer rivals.

3. Mazda CX-5

SafeConsistently earns Top Safety Pick+ ratings. Its structure handles offset crashes exceptionally well, reducing medical payout severity.

4. Ford Escape

Cheap PartsDomestic parts availability is a huge plus. Body panels are cheap and easy for any body shop to source, preventing "storage fee" total losses.

Deep Dive: The EV Exception

Most people assume EVs are expensive to insure. That is true for high-end models using "gigacastings" (like the Tesla Model Y) where a fender bender can total the car. However, the Chevrolet Bolt EUV and Nissan Leaf are exceptions.

Why Bolt/Leaf are Cheap

- • Standard steel/aluminum construction (body shops can fix them).

- • Lower horsepower = lower accident frequency.

- • Mature platforms (parts are widely available).

Why Luxury EVs are Pricey

- • Specialized labor rates ($200+/hr).

- • Battery packs often need full replacement after minor damage.

- • 0-60 in 3 seconds leads to higher loss frequency.

Your Dealership Checklist

Don't sign the paperwork until you've done this.

-

1

Get the VIN. Do not quote "a 2026 Civic." Quote specific VINs. Trims matter. A Civic Sport might be rated differently than a Civic LX.

-

2

Check the "Symbol". Ask your agent for the ISO rating symbol. A higher symbol means higher comprehensive/collision premiums.

-

3

Quote with IDENTICAL limits. Use the same 100/300/100 limits and $500 deductibles for every car you compare. Don't let a dealer trick you with a quote using state minimums.

Scripts to Use

At the Dealership

"I need the specific VINs for the LX and the Sport trims. I'm going to run insurance quotes on both before we talk numbers. If the Sport costs $50 more a month to insure, that changes my monthly budget."

With Your Agent

"I'm looking at a 2026 Subaru Crosstrek. Does this model qualify for any specific safety feature discounts, like EyeSight or passive restraint credits? How does its rate compare to a Mazda CX-30?"

Frequently Asked Questions

Are SUVs more expensive to insure than sedans? ▼

Not necessarily. While SUVs cost more to buy, they often have lower driver injury rates than small sedans, which keeps liability premiums down. Small crossovers like the Subaru Crosstrek are often cheaper to insure than compact cars like the Honda Civic.

Does color affect insurance rates? ▼

No. This is a myth. Insurers care about the VIN, which tells them the make, model, engine, and safety features. They do not know (or care) if your car is red, silver, or black.

Why is my new car cheaper to insure than my old beater? ▼

Modern safety features. A 2026 car with automatic emergency braking and blind-spot monitoring is far less likely to be in a crash than a 2010 car. Insurers reward this risk reduction with significant discounts that can offset the higher value of the vehicle.