You’ve seen the memes. You’ve heard the horror stories. Then the bill arrives, and it’s worse than you imagined. Adding a 16-year-old male to a family policy increases premiums by an average of 161%. For a female teen, it’s about 125%. Check our new driver guide for basics.

But panic is not a strategy. Understanding why the rate is high—and knowing specific levers to pull—can save you thousands of dollars over the next six years.

Key Takeaways

- ✓ The "Discount Stack": Combining Good Student, Telematics, and Driver Training discounts is the only way to offset the 100%+ rate hike.

- ✓ Don't Split Policies: It is almost always cheaper to add a teen to your policy than to buy them a separate one (unless they have a high-performance car).

- ✓ Car Choice is Critical: A 10-year-old midsize sedan costs 50% less to insure than a new SUV. (See vehicle choice impact). Avoid "sport" trims at all costs.

- ✓ Liability Matters: Never lower your liability limits to save money. Teens are high-risk; you need more asset protection, not less.

Table of Contents

Why Are Teens So Expensive?

It’s not bias; it’s data. The crash rate per mile driven for 16-19 year olds is nearly 3x higher than for drivers aged 20+.

Distraction

Teens are digitally native but inexperienced at "task switching." Phone use while driving is a primary cause of major accidents.

Passengers

Crash risk increases by 44% with one teen passenger and quadruples with three or more. Distraction multiplies.

Night Driving

Fatal crash rates for teens are 3x higher at night. Reduced visibility + inexperience = danger.

The "Discount Stack" Strategy

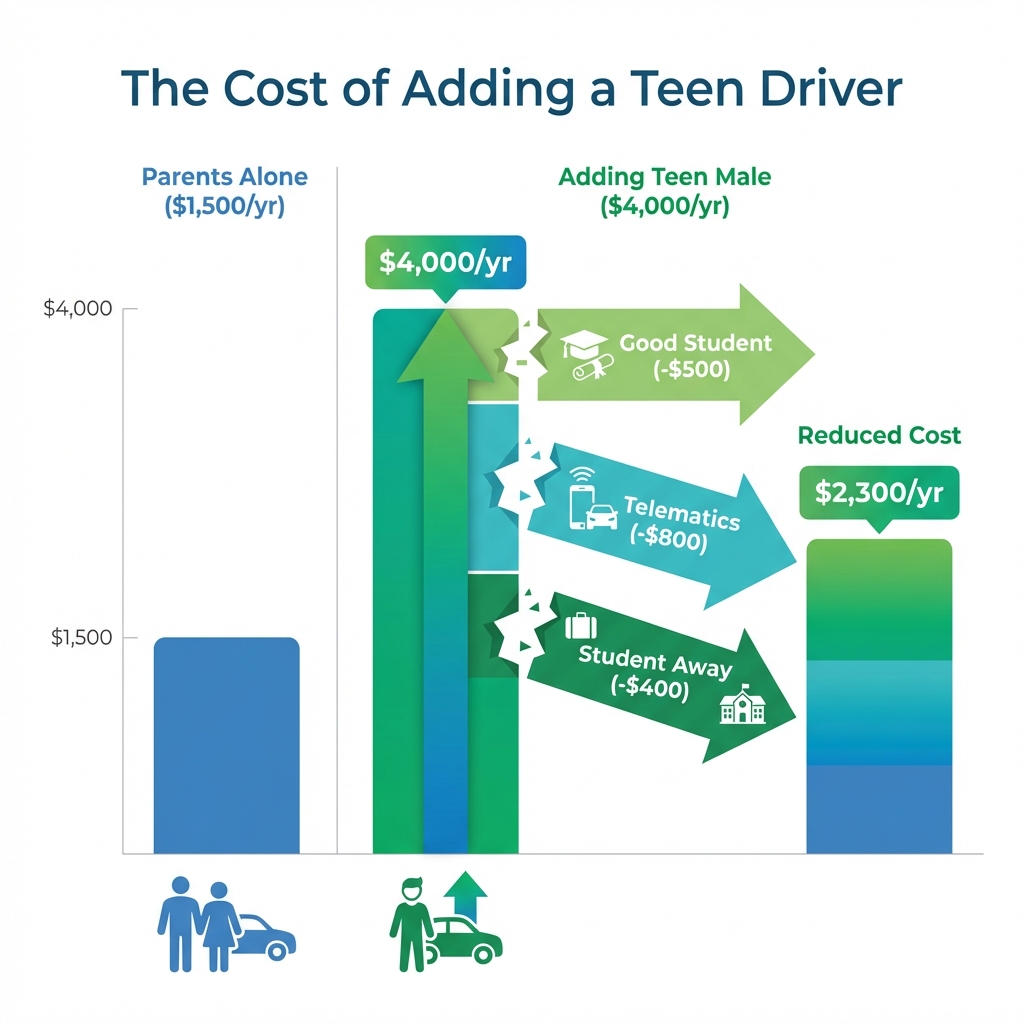

You cannot change your teen's age, but you can change their "risk score." View the infographic below to see how stacking discounts can cut the surcharge in half.

1. Good Student Discount

Save 10-15%Most insurers offer this for a 'B' average (3.0 GPA) or higher. You must re-verify every 6-12 months. Action: Scan the report card immediately.

2. Telematics (Usage-Based)

Save 20-30%Enroll your teen in the insurer's app (e.g., DriveSafe, Snapshot). If they drive safely (no hard braking, no late nights), you get a massive discount. Warning: Poor driving can raise rates in some states.

3. Driver Training

Save 5-10%Completion of an accredited defensive driving course (beyond basic drivers ed) often yields a persistent discount for 3 years.

Adding vs. Separate Policy

Should you kick them off the nest? Usually, no.

| Scenario | Verdict | Why? |

|---|---|---|

| Standard Family Car | Add to Family Policy | You get multi-car and multi-line (home+auto) discounts that a standalone teen policy can't match. |

| Teen Owns Sports Car | Consider Separate | High-risk vehicles ruin the family "average." Isolating this risk might save the parents' rates. |

| Parents have Luxury Cars | "Exclude" Teen | Keep teen on family policy but explicitly "exclude" them from driving the Porsche. Drive the Honda only. |

The Best (and Worst) Cars for Teens

This is the biggest variable you control. Insurers rate cars by "Symbol." High symbol = High premium.

The "Green Light" List

Safe, slow, and cheap to fix.

- Honda CR-V (older gen): Tank-like safety, cheap bumpers.

- Subaru Outback: AWD for safety, uncool (good!), Eyesight tech.

- Toyota Camry (4-cyl): Reliable, boring, predictable.

The "Red Light" List

High horsepower or theft magnets.

- Any Coupe: Two doors = "Sports Car" to insurers.

- Old Heavy SUVs: Prone to rollover with inexperienced drivers.

- Luxury Sedans (BMW/Audi): Parts cost too much; raises collision premiums.

The "Away at School" Loophole

When they head to college, do NOT remove them from the policy (they need coverage when they visit home). Instead, use the "Student Away at School" discount.

- 1. School must be 100+ miles from home.

- 2. Teen must not have a car with them on campus.

- 3. Result: You get ~30% off, but they are fully covered when they come home for breaks.

Scripts to Use

Asking for Discounts

"I am adding a 16-year-old driver. I have his transcript showing a 3.2 GPA for the Good Student discount, and we want to enroll in the telematics program immediately. What is the combined impact on the surcharge?"

Excluding a Vehicle

"I want to assign my teen strictly to the 2018 Honda Civic. Please rate him on that vehicle only and exclude him coverage on the 2024 Mercedes. He will not have access to the keys."

Frequently Asked Questions

Should I lower my liability limits to save money? ▼

Absolutely not. Teens are high-risk. If your teen causes a major accident with multiple injuries, state minimum limits won't cover it, and you (the parent) can be sued for your house and assets. Keep limits high (100/300/100 or better) and consider an Umbrella Policy.

Do permit drivers need insurance? ▼

Usually, no. Most policies cover a driver with a learner's permit under the parents' insurance at no extra cost until they get their license. However, always call to confirm.

Can I own the car but put insurance in my teen's name? ▼

Generally, no. You must have an "insurable interest" in the car to insure it. If you own the title, you must insure it. If you transfer the title to the teen, they can get their own policy (but it will be very expensive).